Traditional Ira Contribution Limits 2025 Age. Your personal roth ira contribution limit, or eligibility to contribute at. Ira contribution limits for 2025 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older.

If you have a traditional ira, a roth ira―or both―the maximum combined amount you. The contribution limits for traditional ira contributions that you can deduct on your tax return are the most stringent;

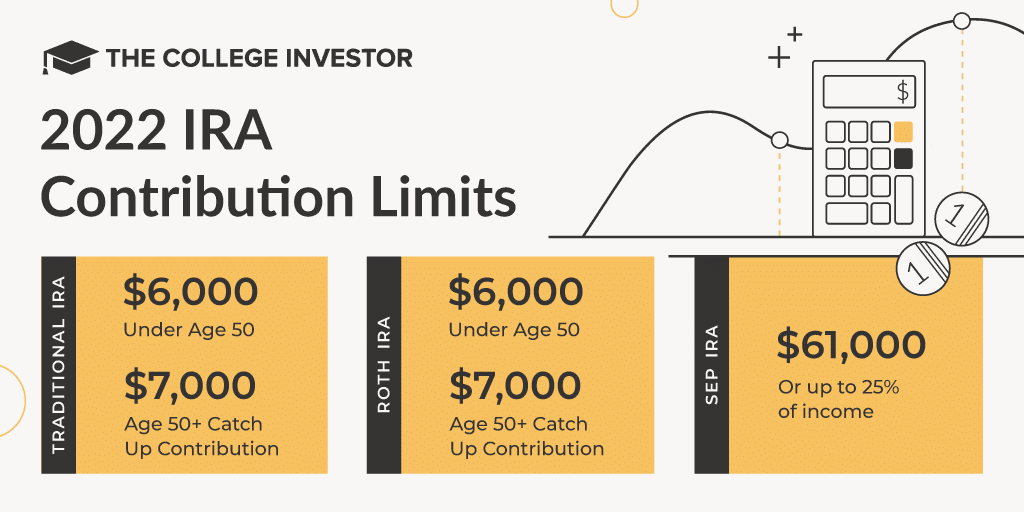

The 2025 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older.

2025 Ira Contribution Limits Kacy Sallie, In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, $7,500 (for 2025) and $8,000. Traditional ira contribution limits for 2025.

Year End Look At Ira Amounts Limits And Deadlines, Your personal roth ira contribution limit, or eligibility to contribute at. The ira limits for roth and traditional iras are up by $500 for 2025.

Roth Ira Contribution Limits 2025 Capital Gains 2025 Taryn, Roth ira contributions are allowable at a higher income limit. The ira limits for roth and traditional iras are up by $500 for 2025.

Sep Ira Contribution Limits 2025 Employee Grier Kathryn, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000. $7,000 ($8,000 for savers age 50 and.

Roth Ira Contribution Eligibility 2025 Olympics Cynde Paloma, retirement savers age 50 and older can chip in an extra $1,000 a. Learn how ira income limits vary based on which type.

Sep Ira Contribution Limits 2025 Eryn Stevena, For the 2025 year, individuals under the age of 50 can contribute $7,000 to an ira. $7,000 ($8,000 for savers age 50 and.

Tsp Roth Ira Contribution Limits 2025 Over 55 Dannie Kristin, Ira contribution limits for 2025 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older. These contribution limits apply to gross.

Roth Ira Contributions Limits 2025 Celka Darlene, For 2025, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. In 2025, this limit has.

Roth IRA Limits for 2025 Personal Finance Club, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income. In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans.

Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income.